50+ can i deduct mortgage interest on rental property

Most homeowners use a mortgage to purchase their own home and the. If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return.

Tax Deductions For Real Estate Agents

Practically every homeowner will need to take out a mortgage to finance their property purchase.

. If youre one of those landlords who possess a. Web The nine most common rental property tax deductions are. Ask Lawyers Online and Get the Answers You Need 247.

Web What Deductions Can I Take as an Owner of Rental Property. Web As such the best source to answer the question about interest payments and tax deductions is the Internal Revenue Service or IRS. Web If you receive rental income for the use of a dwelling unit such as a house or an apartment you may deduct certain expenses.

Yes you would only enter the balance. Web Interest on Your Mortgage. Why Wait and Be Unsure.

Web If you are charging 10000 in rent for your property and are being charged 9000 in mortgage interest then you will be taxed on the full 10000 income. The IRS is ahead of you on your thinking that using the filing status married filing. Web You and your wife cannot deduct mortgage interest on more than two homes.

Instead it is added to Kens basis in the home and depreciated over 275 years. Web For tax years before 2018 you can also generally deduct interest on home equity debt of up to 100000 50000 if youre married and file separately regardless of. These expenses may include mortgage interest.

Web Up to 25 cash back The 10000 loan amount is not deductible. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Key Takeaways.

Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals. First Time Home Buyer. You would need to take.

The mortgage interest on your rental. These expenses which may include. Most residential rental property is depreciated.

Web Yes if you receive rental income from a property you are entitled to deduct certain expenses including mortgage interest property tax operating expenses. Rental property owners can deduct the costs of owning maintaining and operating the property. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

And this question is answered. The standard deduction is 19400 for those filing as head of. Web You can deduct expenses from your rental income when you work out your taxable rental profit as long as they are wholly and exclusively for the purposes of renting.

Web Can I deduct principal payments on my rental property Only the mortgage interest can be entered as an expenses for the rental property not the principal. Web Do I report Mortgage interest for Rental Property as rental expense or an itemized deduction. Ad Get Streamlined Access and Unlimited Legal Questions.

Ask Online Right Now. Easily Compare Mortgage Rates and Find a Great Lender. Web Dear Sunny Youd like to refinance to get a rental property deduction.

Web The mortgage interest deduction can also apply if you pay interest on a condo cooperative mobile home boat or RV used as a residence. Thats possible but your losses may be limited. The interest payments Ken makes on the.

Tax Strategies Blog Greenbush Financial Group

2014 Tax Update

Solved Rental Income Below Fair Market Value

50 Effective Security Deposit Return Letters Ms Word ᐅ Templatelab

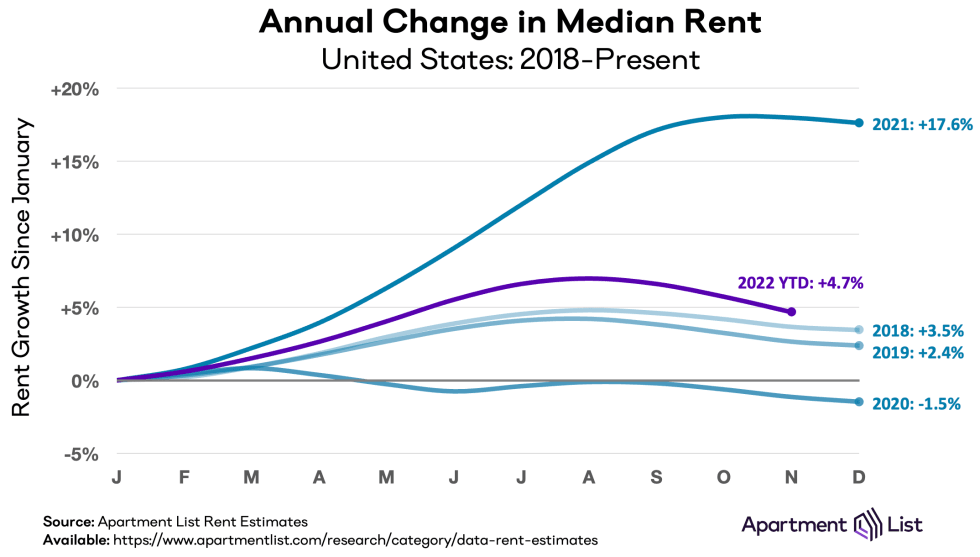

How Long Will Rent Increases Last Some Advice For Renters

Real Property Tax Howard County

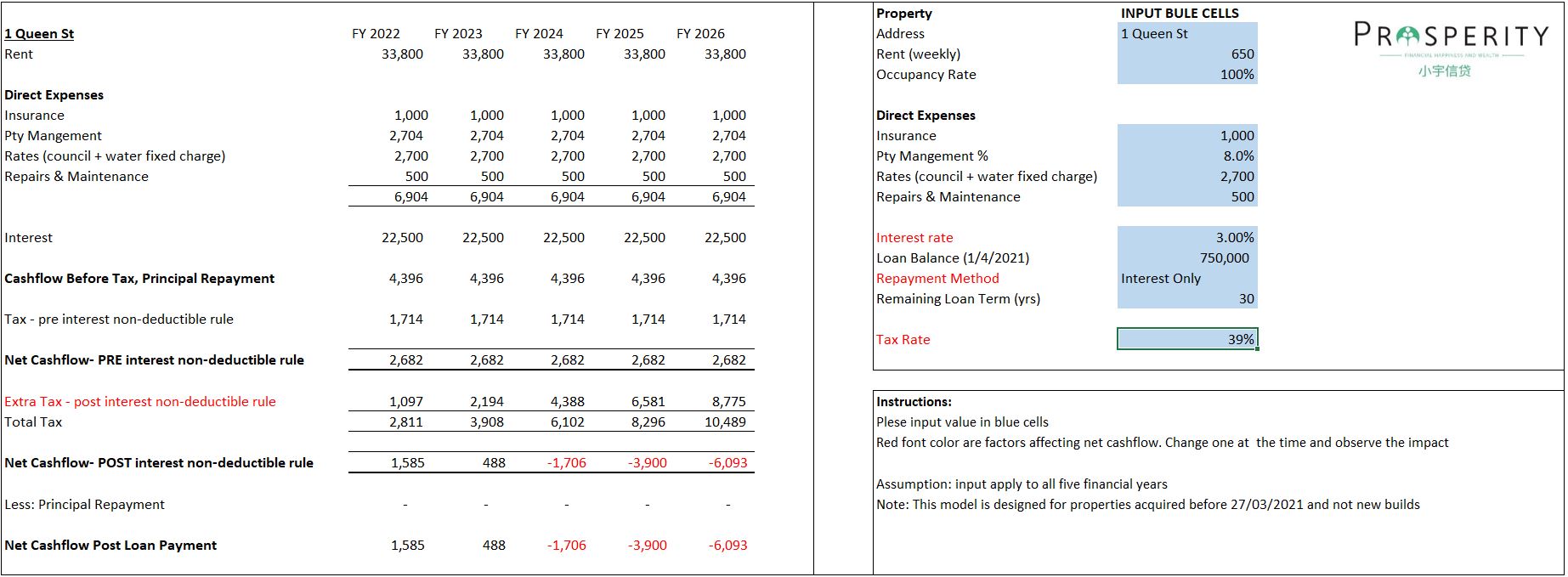

New Housing Policy 2021 No Interest Deductions On Residential Rental Property

Bonus Depreciation Rules For Rental Property Depreciation

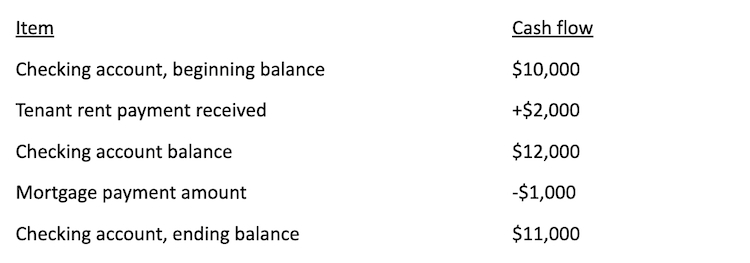

Is Your Mortgage Considered An Expense For Rental Property

Is Your Mortgage Considered An Expense For Rental Property

10 Most Expensive Tax Mistakes That Cost Business Owners Thousands Ppt Download

Rental Property Tax Deductions Top Deductions To Utilize

Can You Claim Rental Mortgage Interest As An Itemized Deduction

How Long Will Rent Increases Last Some Advice For Renters

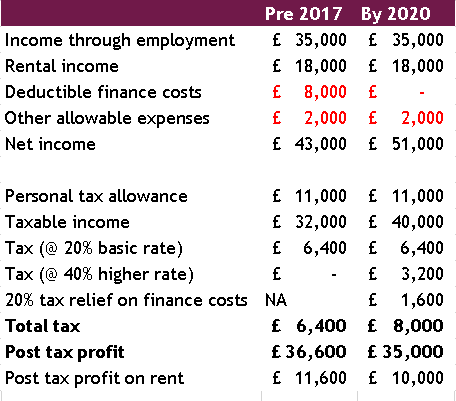

Landlord Tax Liabilities Tax On Rental Income Tenant Tax Property Rental And Tax Return Tax Deduction For Mortgage Interest Who Fills The Self Assessment On Rental Income From Joint Property Tax Deductible

:max_bytes(150000):strip_icc()/house-keys-and-contract-on-table-in-house-rental-1082558850-f4ceefa00b2f4b08b84c4ae77d17dd65.jpg)

The Tax Benefits Of Owning A Rental Property

Landlord Tax Changes Come Into Effect April 2017